A joint venture investor is a person or entity that has the resources or funds to put at risk for the long term. The investor needs to understand that he will need to also guarantee the note and mortgage on the construction / permanent loan.

The investor needs to understand that JV’s are well managed only if the investor and the sponsor are in agreement and the MOU or OA has stood the test of time.

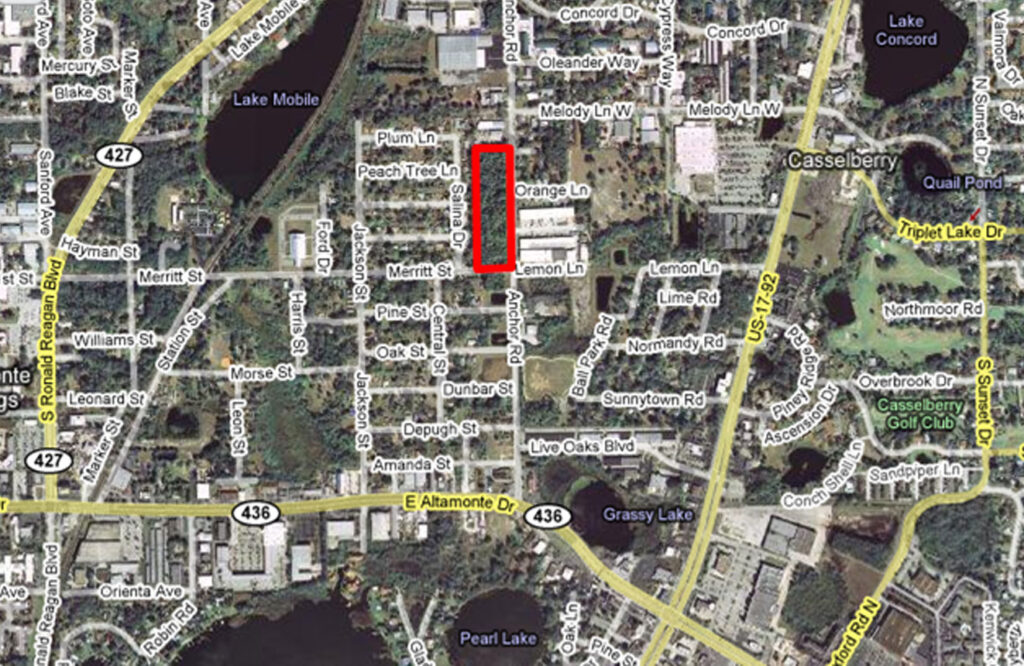

Because we have over 1,140 permanent residences moving to Florida every day, and 1,500 moving to Central Florida every week, and we are building with concrete block and steel, and because I cannot find any clean and up-to-date, move-in-ready, small bay, grade level flex space available, the risk in this development is lower than the double digit returns to the investor.

No one cannot predict a life span. The life span of a JV is varied and mixed. The life span depends on the industry, economics and current local and national economy. It is my understanding that the average life span of a joint venture is less than five years.

Ownership splits are varied and mixed. Many have a 50:50 split. Some have 60:40, 70:30, or another split that works for them. This JV will have a 50:50 split.

Five major issues:

- Compatibility issues between partners.

- Lack of cash to fund repairs and maintenance.

- Significant unexpected operating costs.

- Poorly worded Joint Venture Agreement.

- Agreed to expectations were not met.

This answer depends on what part of the market is “hot”. Previously, business and real estate. Today, technology, business expansion and commercial real estate is the most common Joint Venture. The positive statewide net in-migration demographic has made Florida commercial real estate an attractive Joint Venture investment.

- Cohesive and compatible partners and sponsors.

- A very well worded MOU or OA,

- Reasonable expectations that match the results.

- Attentive and experienced full time knowledgeable hands-on management.

- Sufficient cash

- Most important, profitable financial results.

- In the beginning the investors own 100% of the development and they receive 100% of the cash flow. Because the investors receive 100% of the cash flow, there are no funds for interest.

- After the investors investments are fully paid back, the cash flow and ownership are split 50% to the investors and 50% to the Sponsor, Developer or Managing Partner.

- Understand that the investors and Sponsor are funded after all reserves are funded.